Latest Reviews

-

38News

38NewsArcade1Up announces partnership with Taskrabbit to offer at-home assembly services

Arcade1Up has teamed up with Taskrabbit to help make your dream of owning a home arcade a reality! Arcade1Up has been listening...

-

52News

52NewsDarkest Dungeon II set to launch on PlayStation this year, DLC “The Binding Blade” will also be available

Red Hook Studios just announced that Darkest Dungeon II is heading to the PlayStation 4 and 5 on July 15th, 2024, with...

-

101News

101NewsGet ready undead-sniping heroes! A new Zombie Army VR trailer was just released

Get ready undead-sniping heroes, because a new story trailer for Zombie Army VR was just released. Zombie Army VR takes place alongside...

-

79News

79NewsSystem Shock receives major content update on PC, includes an expanded ending, a new female hacker protagonist, and more!

The System Shock remake has just received a major content update on PC, patch v1.2, which revises the ending, adds a new...

-

276News

276NewsThe battlefield gets extra smoky as Cheech and Chong bust a cap into your Call of Duty

You already saw it in the battle pass and bundle blog for Call of Duty’s Season 3 content, and they’re here. In...

-

260News

260NewsDream another dream in Sonic Dream Team’s second content update

Today, SEGA released the seecond of three content updates for their Apple Arcade game, Sonic Dream Team. The update will be available...

-

258News

258NewsSurprise turtle attack! Teenage Mutant Ninja Turtles: Splintered Fate hits the streets in July

We’ve been absolutely blessed with the Teenage Mutant Ninja Turtles with several new releases recently. Between Shredder’s Revenge, the TMNT classic collection,...

-

240News

240NewsGhost of Tsushima Director’s Cut unveils PC requirements and new PlayStation overlay and cross-play features

We’re all patiently awaiting Ghost of Tsushima’s arrival on PC, and today via the PlayStation Blog, the Online Community Specialist from Nixxes...

-

280News

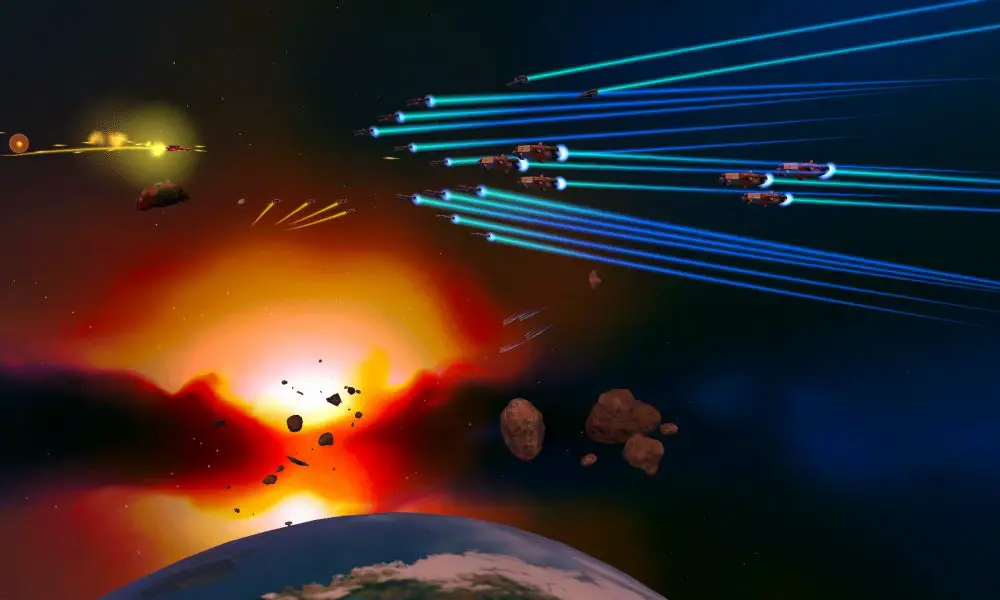

280NewsHomeworld 3 jumps into hyperspace with future content roadmap

We’re all excited about Homeworld 3’s upcoming release, and that’s not all there is to look forward to. Today, Gearbox Publishing and...

-

264News

264NewsNintendo’s Spring Indie World showcase delights with looks at Another Crab’s Treasure, new TMNT game, and more

Nintendo Indie World showcases are always great to see. This spring’s version of the show had a ton of great things to...