Latest Reviews

-

143News

143NewsTune in next week for an ATLUS Exclusive livestream on Metaphor: ReFantazio

Today, ATLUS announced they will hold a livestream on the ATLUS West YouTube channel showing never-before-seen gameplay of their upcoming fantasy RPG...

-

148Impressions

148ImpressionsThe Art of Final Fantasy XVI & Poster Collection impressions — A standard art book for an outstanding game

I adored Final Fantasy XVI (our review here), and I’m always a sucker for artbooks, so let’s get straight into things. The...

-

263Reviews

263ReviewsFlexiSpot C7-foam-FT review — Chair-ished comfort

Despite there being a whole genre of chairs made for playing games, I don’t find them very comfortable. They’re not particularly flexible...

-

368Reviews

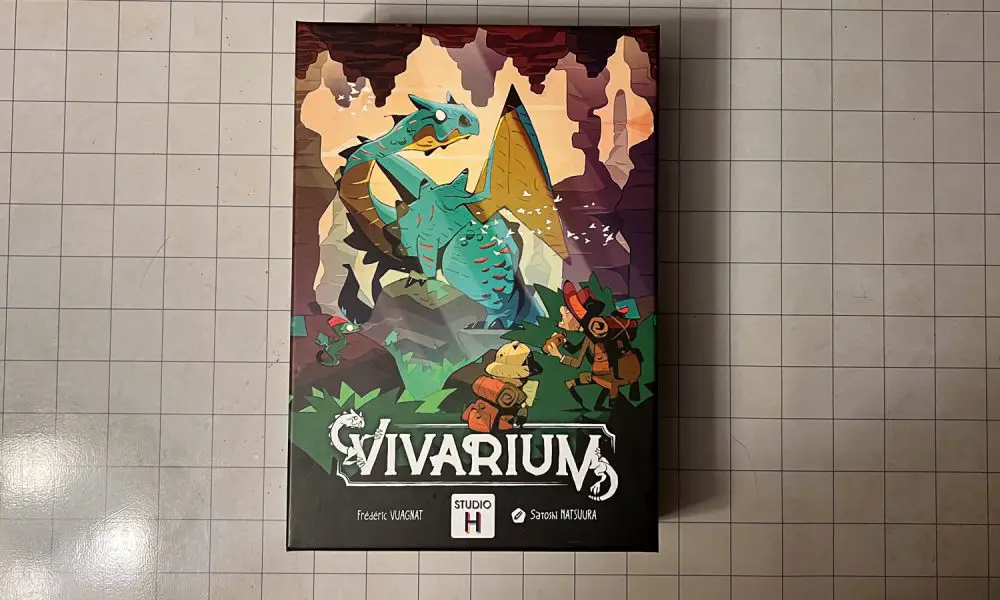

368ReviewsVivarium Review — An ode to discovery

I find that easy to learn, filler games are really important on tabletops these days. Having just come back from a wargaming...

-

316News

316NewsLaunch trailer for ARPG No Rest for the Wicked released

With its Early Access release on April 18th just days away, Moon Studios and Private Division have released a launch trailer for...

-

478Interviews

478InterviewsInterview with Ross Scott on the campaign to prevent publishers from destroying purchased games

The video game industry sits at an insidious nexus of profitable and technological; it makes shady decision-making lucrative and insulates those decisions...

-

322News

322NewsRØDE announced three new products at NAB 2024 – the Interview PRO, a Phone Cage, and a Magnetic Mount

During yesterday’s NAB event in Las Vegas RØDE announced the Interview PRO, a broadcast-quality wireless handheld microphone, and two premium smartphone filmmaking...

-

432Reviews

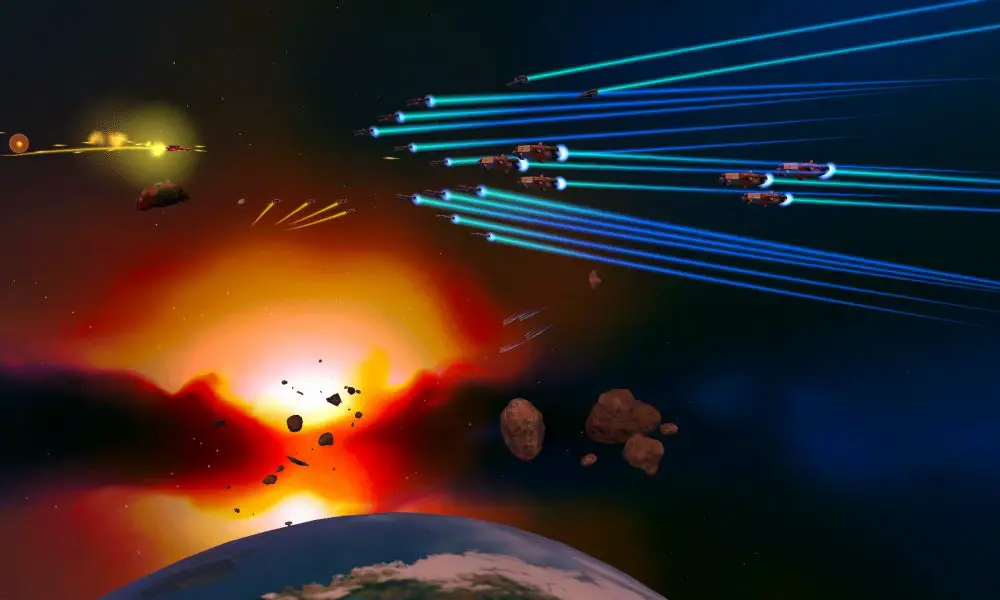

432ReviewsHarold Halibut review — There’s more than fish in the sea

It’s been two and a half centuries since the crew aboard the FEDORA 1 ark ship fled Earth in search of new...

-

529Reviews

529ReviewsJimmy and the Pulsating Mass review — a work of genius and empathy makes this JRPG a new classic that should not be ignored

Jimmy and the Pulsating Mass is among the greatest gifts that came out of RPGmaker’s toolsets, delivering an adventure with unmatched quality...

-

632Reviews

632ReviewsThe Last Case of Benedict Fox: Definitive Edition review – In Limbo no more

Last May, we gave you our first impressions of the Lovecraftian Metroidvania The Last Case of Benedict Fox on Xbox Series X....