Latest Reviews

-

230News

230NewsThe ball gets passed to the wide receivers in Wild Card Football’s latest legacy pack

If you’ve been following Wild Card Football, you’ve seen several cool packs drop including past All-Pro players. Now, it’s the receivers turn,...

-

198Reviews

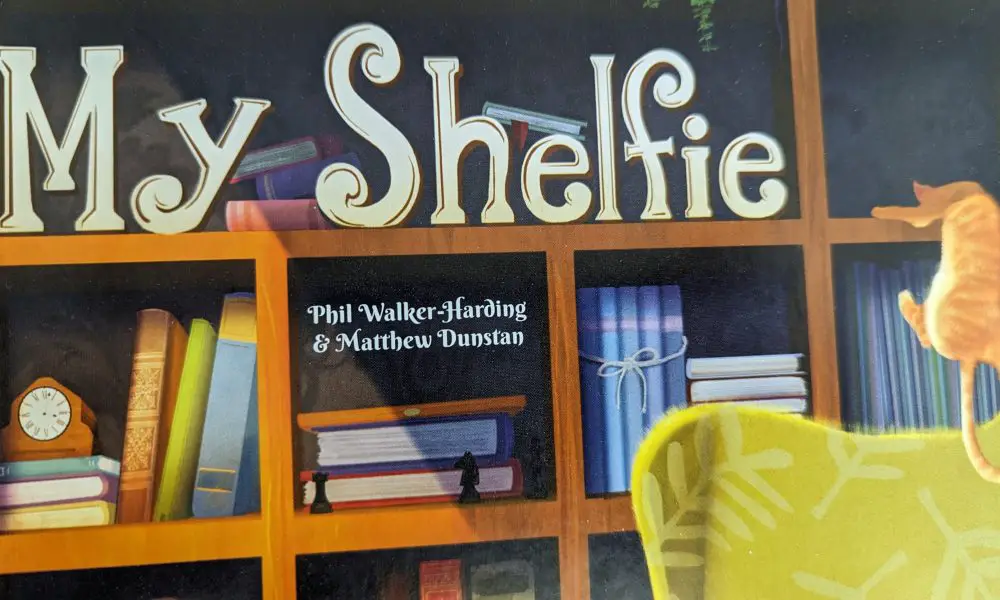

198ReviewsMy Shelfie review — Don’t be a square, put the squares in the square

As much as my collection has exploded since I started reviewing and didn’t stop buying my own games, there’s been a niche...

-

181News

181NewsGet another season’s worth of content as Season 3 Reloaded of Call of Duty: Modern Warfare III, Warzone, & Warzone Mobile arrives May 1

It’s crazy, but we’re already halfway through Season 3 of the latest Call of Duty season. What might be more insane is...

-

192News

192NewsRoll and rumble in Super Monkey Ball Banana Rumble’s Multiplayer Battle modes

Today, SEGA revealed addditional details on the Multiplayer Battle modes in Super Monkey Ball Banana Rumble, launching on Switch June 25th. Get...

-

255News

255NewsRiven is back! Check out the first official gameplay trailer and cast reveal

Riven, the all-time classic narrative puzzler, just received its first gameplay trailer for its upcoming remake, along with the cast finally being...

-

208News

208NewsArcade1Up announces “Lobbies for Connected Play” for the Infinity Game Table and Infinity Game Board

Arcade1Up just announced that their Infinity Game Table and Infinity Game Board will both be receiving a massive update which will allow...

-

314News

314NewsMad Mimic unveils Mark of the Deep, an ambitious new action-adventure game

Mad Mimic, known for their indie hits Dandy Ace and No Heroes Here, just unveiled their next title Mark of the Deep, ...

-

249News

249NewsInflexion Games offers details on their April update for Nightingale, along with a new gameplay video and developer diary

Inflexion Games has released a new update for Nightingale, which released in February in Early Access. This new update was created after...

-

530Reviews

530ReviewsSaGa Emerald Beyond Review – Five’s a party

SaGa has been around since 1989, having released 15 titles as of writing this. We’ve seen this game on almost every platform...

-

273News

273NewsESO 10th Anniversary: Commemorative Coin Set Now Available

Holly Hudspeth, or resident Elder Scrolls Online addict, has been playing the game since the beta. She’s also reviewed every expansion since...