Latest Reviews

-

135News

135NewsIGN Live arrives at the Magic Box in LA June 7-9 with loads of video game goodness, tickets available now

Ready for all the video game news to hit us again? We might not have E3, but IGN is bringing their own...

-

164News

164NewsWe Interview: James Robbins from Dynabook about their new products and school partnerships!

We recently had a chance to talk to James Robbins from Dynabook about their new E-11 computers, their mission, and the partnerships...

-

177News

177NewsAtari has revived Infogrames as a publishing label, picks up Totally Reliable Delivery Service IP

Atari recently announced that they have established a new publishing label under Infogrames, with a purpose of acquiring IPs and publishing. The...

-

164News

164NewsDive into the festival with PDP’s RIFFMASTER guitar, now compatible with Fortnite Festival!

The PDP RIFFMASTER guitar is one of the more popular accessories around, and you’d imagine it’d work with the biggest video game...

-

204News

204NewsCheck out the latest Destiny 2: The Final Shape trailer as you prep for battle

Destiny 2’s The Final Shape expansion is shaping up to be the swansong of the series, and it looks incredible. It’s always...

-

160News

160NewsKrafton Inc., known for PUBG and other hits, acquires minority stake in Far From Home

Krafton Inc. just announced that they have acquired a minority stake in Far From Home, the creators of Forever Skies. Krafton Inc...

-

226Reviews

226ReviewsSucker for Love: Date to Die For — Can love bloom in the outer realm?

The Thousand have taken over your childhood home of Sacramen-Cho. By summoning the eldritch entity known as Rhok’zan, the Black Goat of...

-

266Reviews

266ReviewsTeenage Mutant Ninja Turtles Arcade: Wrath of the Mutants review — Sloppy Sewer Surfin’

As their title implies, mutation is vital to the Teenage Mutant Ninja Turtles’ existence. Every few years the TMNT resurface and evolve...

-

189Reviews

189ReviewsThe BOYAMIC review — Crystal clear audio and a variety of recording options, all in one small plug-and-play package

I recently began to dive into creating more video-based content for GamingTrend, specifically to better provide coverage while attending conventions, and quickly...

-

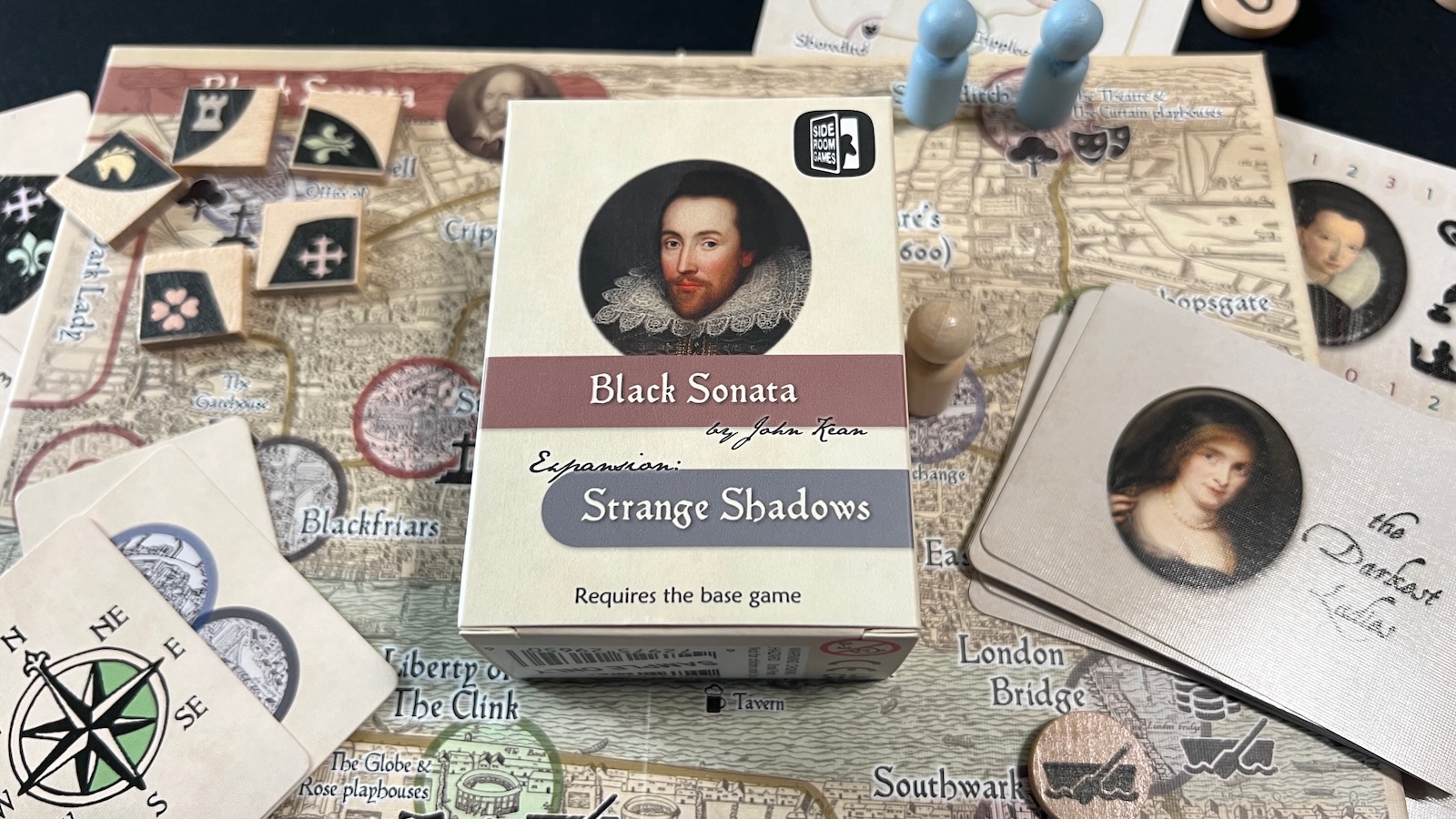

333Reviews

333ReviewsPhantom Fury review – Bloody, messy, and buggy retro anarchy

I’ve played a few games in my time that lacked personality. Phantom Fury is not among them. Never in my gaming career...