Latest Reviews

-

56Reviews

56ReviewsFactory 42 review — Dwarven dynamics through worker placement and negotiation

Step into the bustling corridors of Factory 42, where you’re thrust into the role of overseeing Marxistic dwarves in an industrialized setting...

-

71Reviews

71ReviewsQawale review — Tic-Tac-Yes

Continuing on my quest to play every two player abstract game that Gigamic and partner Hachette Games has to offer, we have...

-

132Previews

132PreviewsHades II Technical Test preview — So mote it be

All of Supergiant’s games are masterpieces, but Hades took the world by storm. Its addictive rogue-like gameplay, compelling story and characters, and...

-

147News

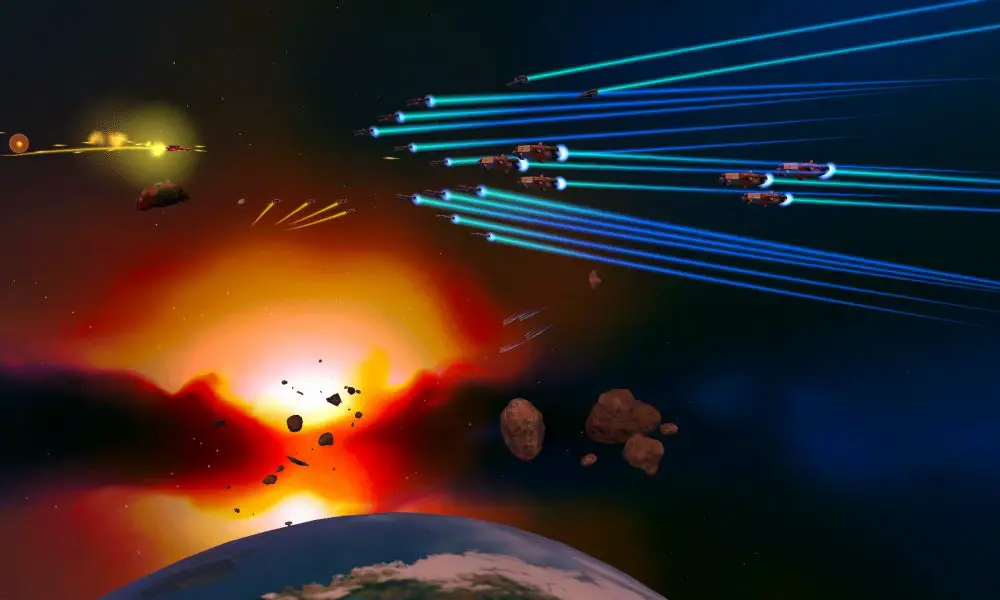

147NewsAres Games partners with Tablescope to distribute Light Speed: Arena, the first photo-based tabletop shooter

Check out the latest press release from Ares Games: In a universe where space battles are a celebrated sport, command a fleet...

-

209News

209NewsPaizo announces Pathfinder: War of Immortals meta event

Paizo is back with some big news about some of the upcoming Pathfinder products. Check out their press release: Tuesday, April 16th,...

-

172News

172NewsiBUYPOWER unveils new VALORANT Champions Tour (VCT) Americas themed gaming PC systems at Best Buy

iBUYPOWER, a leading manufacturer of high-performance pre-built gaming PCs, has unveiled their VALORANT Champions Tour (VCT) Americas themed gaming PC systems. iBUYPOWER...

-

157News

157NewsWarhorse Studio announces Kingdom Come: Deliverance II, arriving 2024

I fondly remember when Warhorse first announced Kingdom Come: Deliverance. I was a backer of it on Kickstarter and it was amazing...

-

199News

199NewsRazer gives the Kishi an upgrade with newest model, Kishi Ultra

There is always a debate on whether mobile players are gamers, but at this point, they outnumber people using PCs and consoles....

-

172News

172NewsElgato makes it easy to hop into content creation with new Neo line

Have you wanted to start making YouTube videos or podcasting but really don’t know where to start? Or is the selection of...

-

184News

184NewsWreck-It Ralph inspired season for Disney Speedstorm is available now

A new Wreck-It Ralph inspired season for Disney Speedstorm, called Sugar Rush, is now available on PC and consoles. This latest season...